Mercury is a fintech company, not an FDIC-insured bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust, Members FDIC. Deposit insurance covers the failure of an insured bank.

Everything you need to run your ecommerce finances

Powerful business banking, without the fees

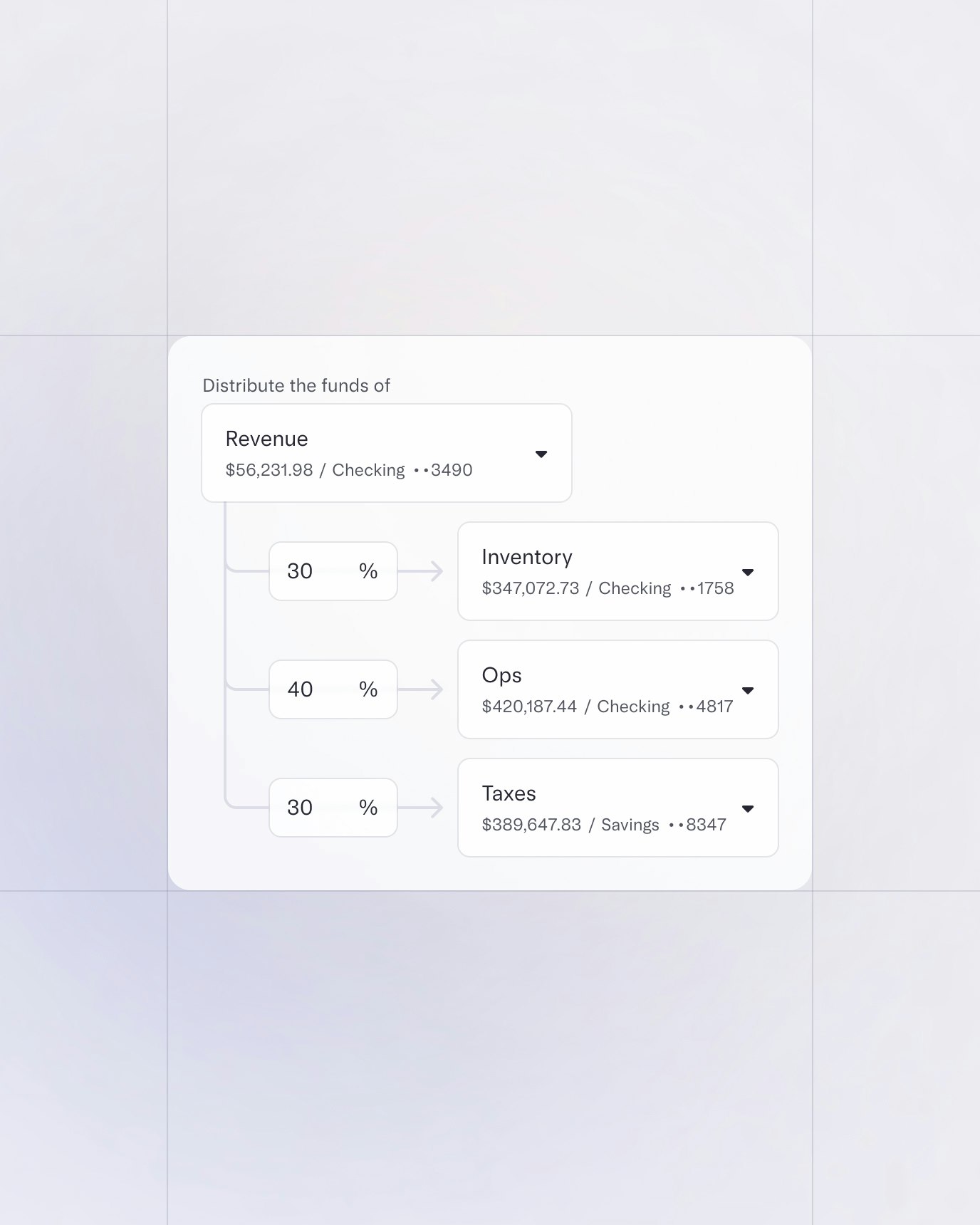

Open Account- Free ACH and wires in USD, plus payments in 40+ currencies for a 1% fee

- Auto-transfer rules to organize and allocate your revenue

- A single place to manage all of your ecommerce finances

Uncapped 1.5% cashback on all credit spend

Explore Cards

Financial workflows for all the ways your money moves

Explore Workflows- Drag-and-drop bills to pay your vendors effortlessly

- Easily request and store tax documents from vendors and contractors

- Create professional invoices for your wholesale customers

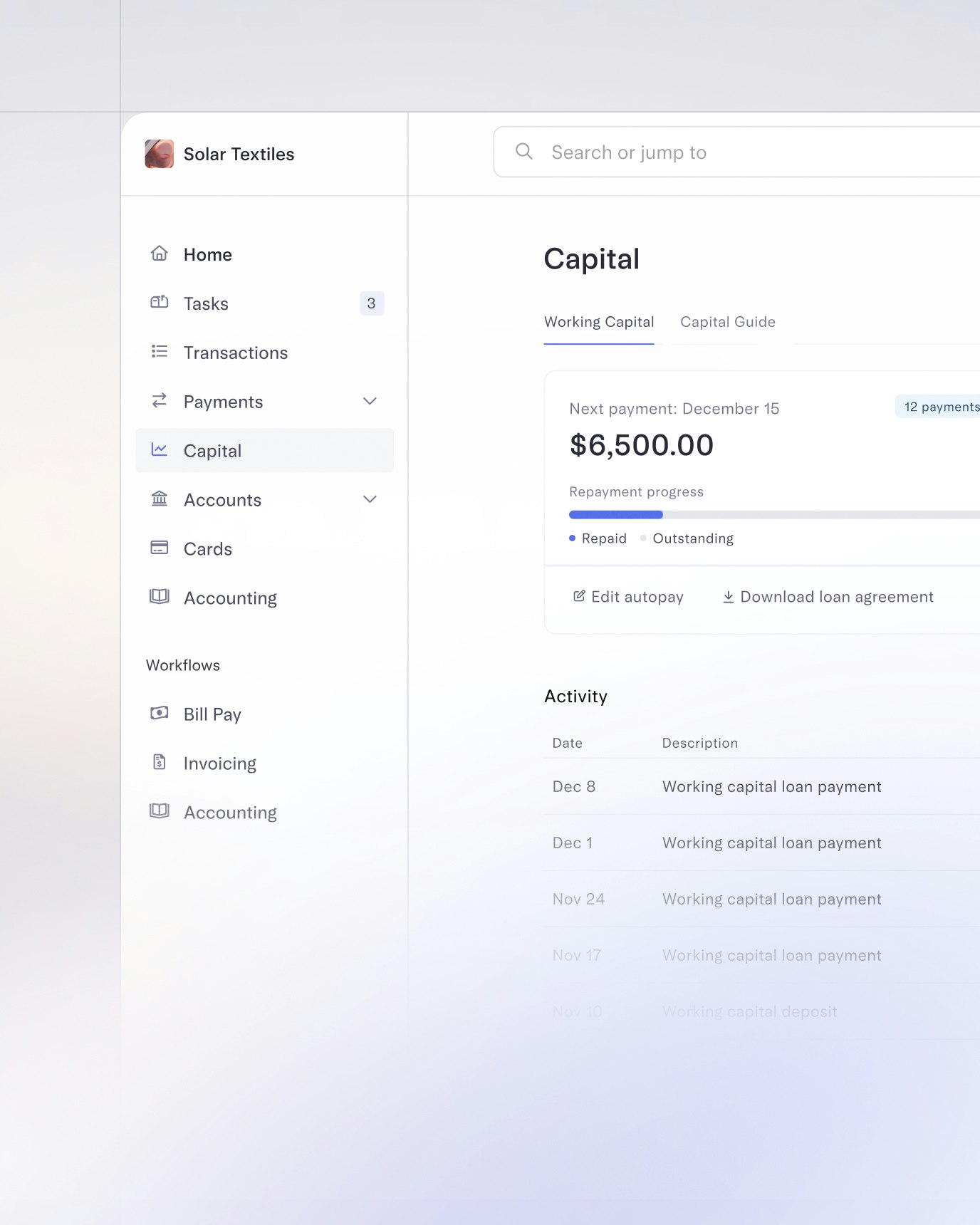

Cash to fund what’s next?

Add to cart.

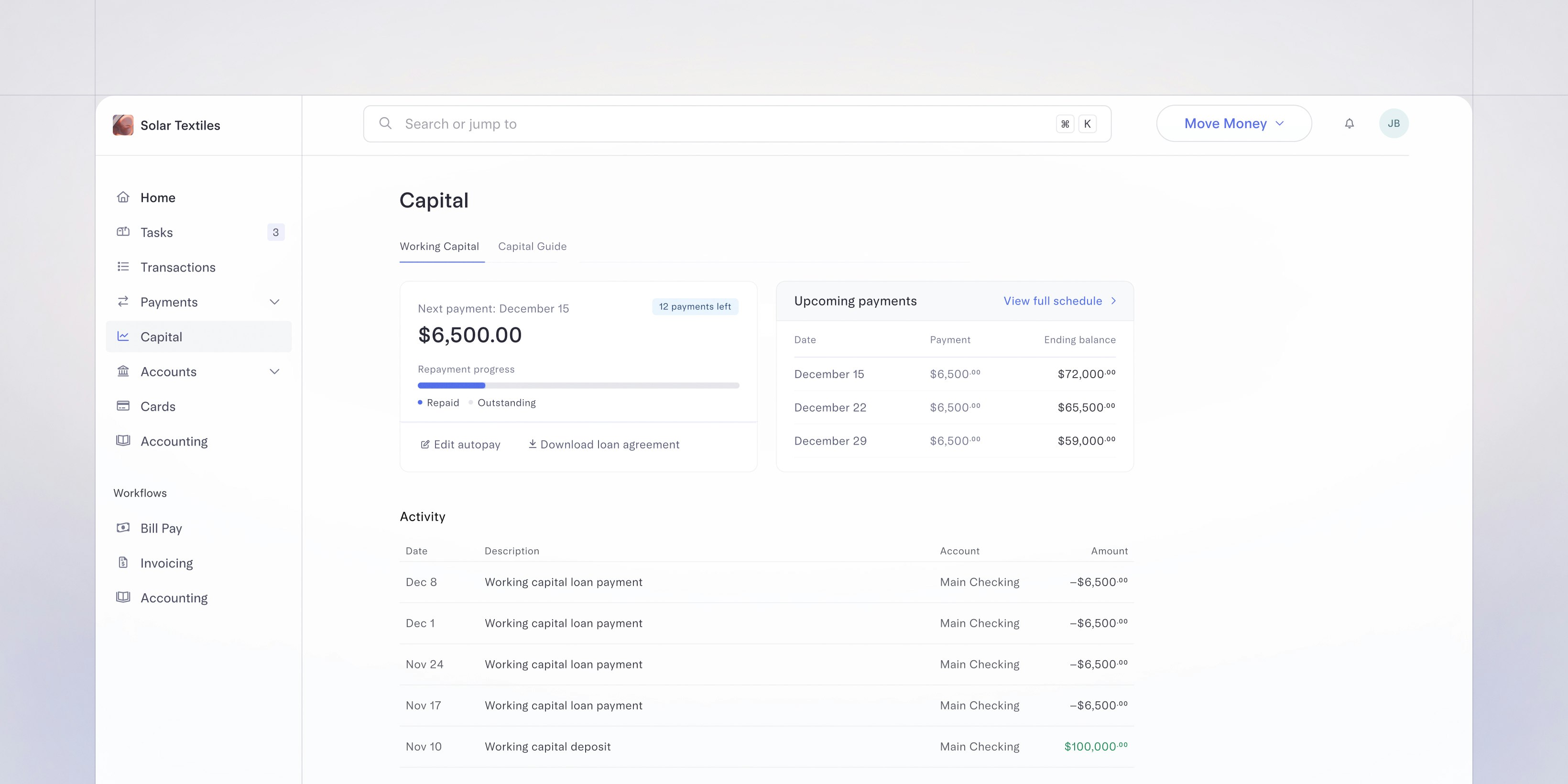

Flat-fee pricing and competitive rates

Easy-to-understand terms so you know your true cost of capital.

Fixed weekly repayment schedule

Forecast your finances without the unpredictability of revenue-based payback.

Long-term partnership

Get a helpful consultant with ecommerce expertise as you run, grow, and scale.

Better online banking for what you're building

Mercury is so intuitive and saves us so much time. Plus, free international USD transfers save us a ton of money when we pay our suppliers overseas.

Mark Zhang

CEO

Manta Sleep

Ecommerce

Virtual accounts, unlimited accounts, accounts with custom names. An app that actually works. You’d think these things would be common sense, but only Mercury truly nails them.

Jimmy Hayes

Co-founder

Minaal

Ecommerce

Mercury makes it quick and easy to monitor my finances with a streamlined, easy-to-use interface and mobile app. My favorite feature is Mercury Bill Pay, which lets me auto-forward all my bills and stay on top of due dates without the stress.

Kyle Siegel

Founder

Raide

Ecommerce

Trusted by 200K+ ambitious companies and ecommerce businesses