Designed for scaling companies

First-class terms

We offer straightforward payback plans, minimal dilution, and competitive interest rates.

For the long run

We’re here through it all. We can chat about refreshing your loan with your next VC round.

Sector-agnostic

Lending for VC-funded companies across stages and industries.

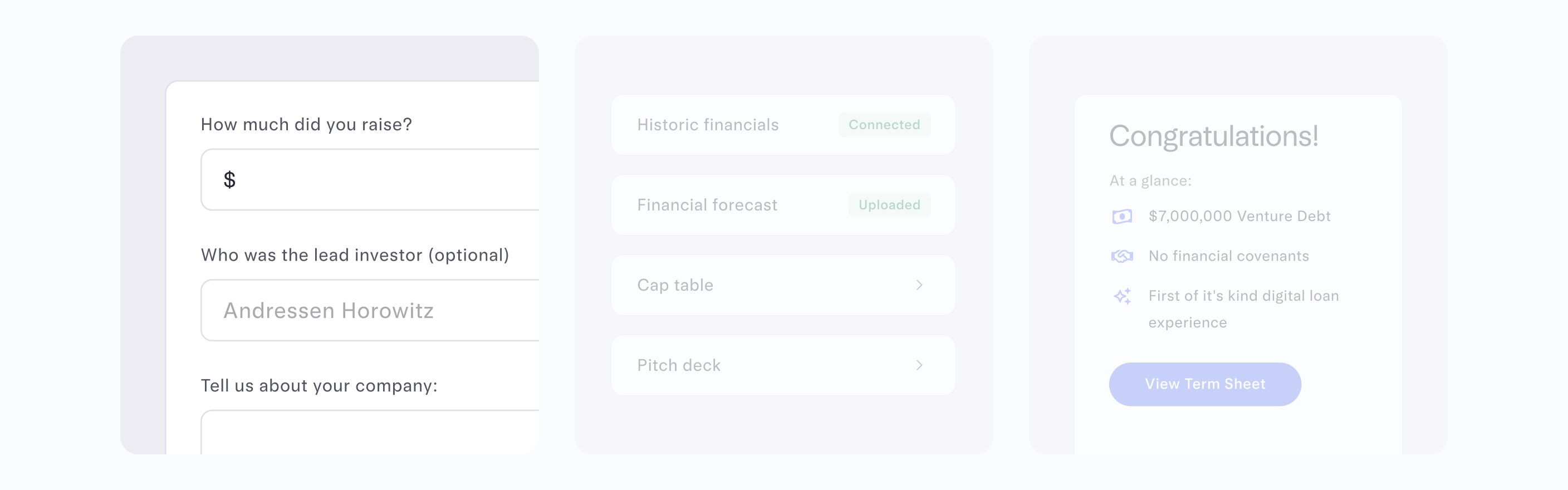

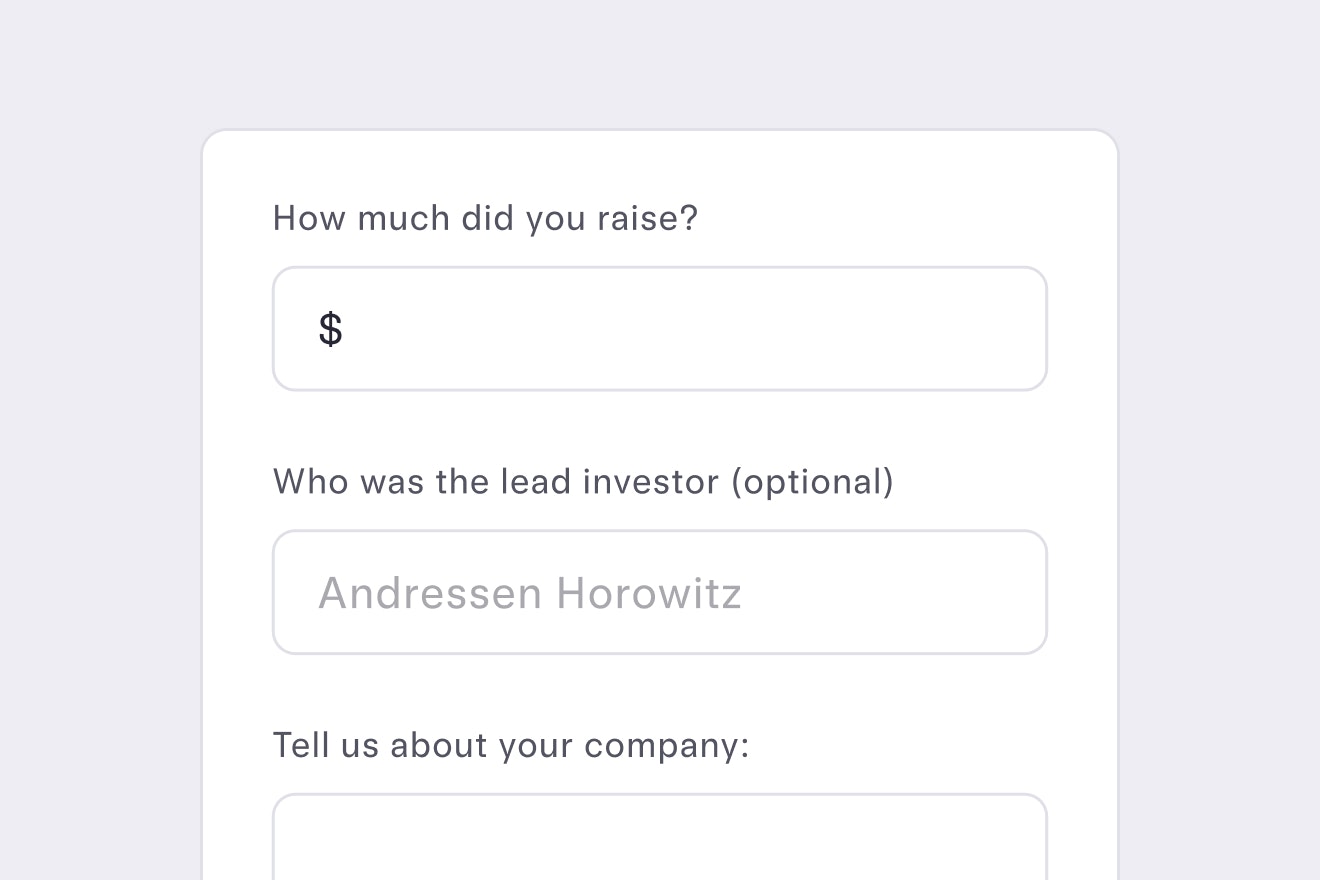

See if you're eligible

Complete our simple, confidential questionnaire to find out if your company is a good fit.

Check EligibilityVenture debt, reimagined

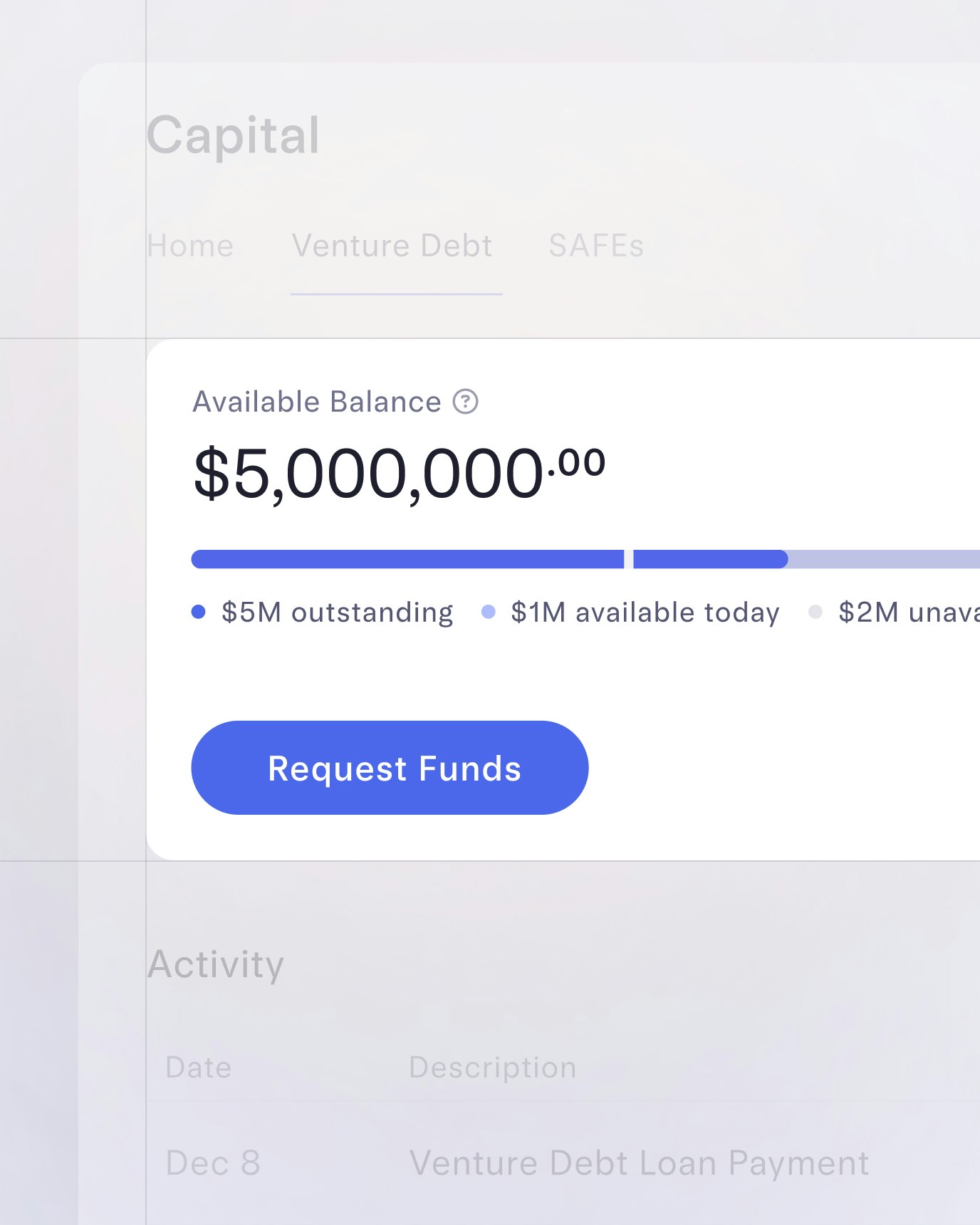

Easy access to your funds

Request withdrawals and see how much capital you have left in just a few clicks.

Dedicated team of advisors

Get 1:1 guidance from both a capital advisor and relationship manager, who leverage their banking expertise and deep network to provide solutions that make sense for your goals.

Don't just take it from us

Mercury Capital is beyond impressive. They are faster, easier to work with, and offer terms just as competitive — if not more — than the most established players. They’ve redefined the industry.

John Andrew Entwistle

Founder & CEO

Wander

Proptech

Mercury has been awesome to work with. Simply put, their venture debt offering is cheaper, better, and faster than the competition. And their team goes above and beyond to be helpful. We couldn’t have asked for a better partner.

Daniel Chan

Co-founder

Mayfair

Fintech

We’ve chosen to work with Mercury since day one because of the simplicity they bring to our finances. That experience has carried over to venture debt — the process was transparent and easy and the terms were fair.

Jonathon Barkl

Co-founder & CEO

AirGarage

SaaS

The Mercury team was supportive throughout the process and we closed our deal quickly. They really eased any nerves we had about venture debt.

Paul Drysch

Founder & CEO

PreAct

Automotive tech

Mercury is built by entrepreneurs, for entrepreneurs. With their unrivaled venture debt and all-in-one financial platform, they’re the ideal partner for us to build and scale our business long-term.

Jonathan Segal

Co-founder & COO

Zeno Power

Climate tech