How we keep your funds safe

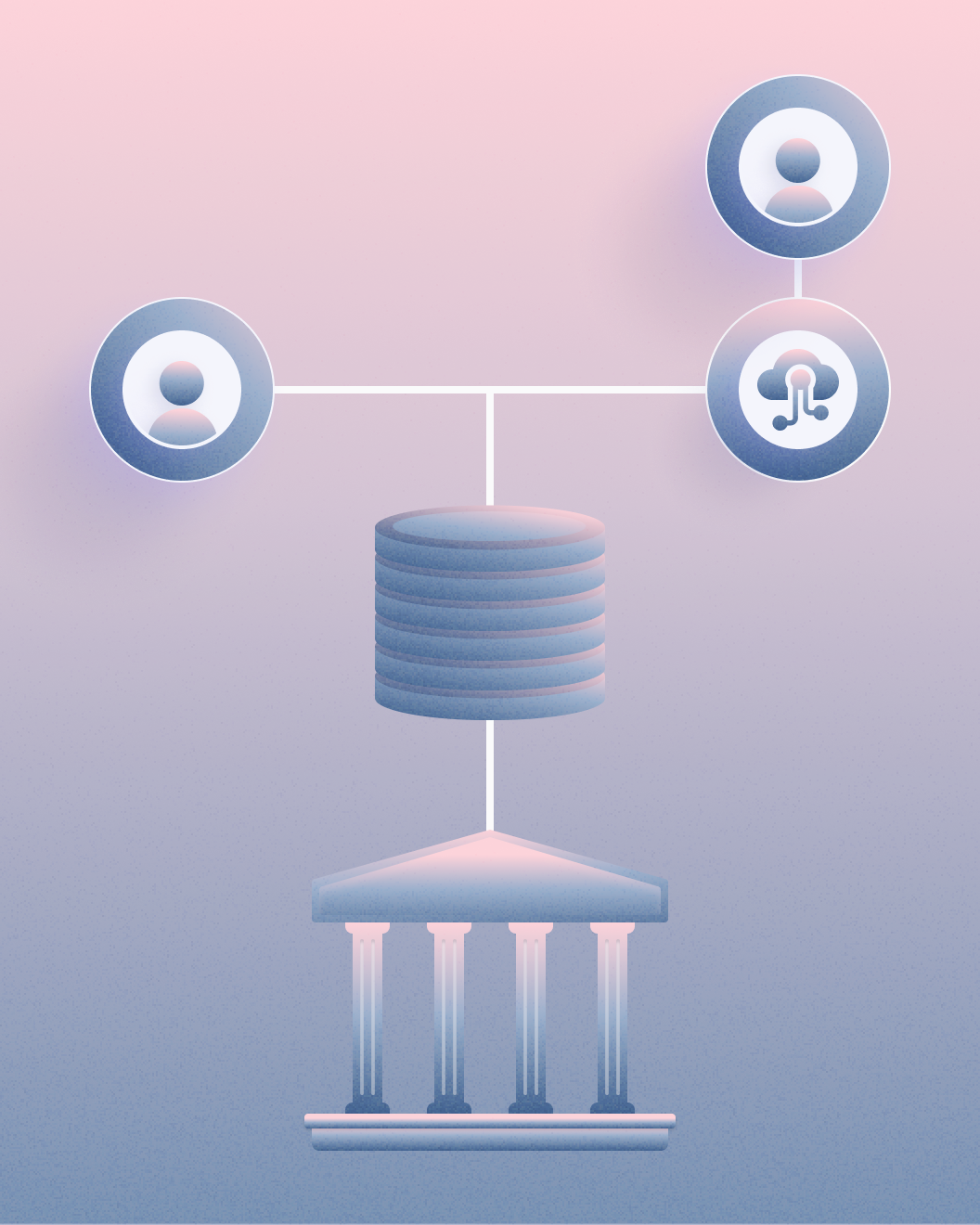

Your deposits are held in your name

Every Mercury account is structured as an individual demand deposit account (DDA), giving you full ownership, transfer rights, and FDIC insurance eligibility by law — with no middleware in between.

Read More

Never lose sight of your funds’ protection

With Mercury Vault enabled on every account, you have an automatic and up-to-date view on exactly how your funds are protected.

Diversified by design

We spread your deposits across a network of FDIC-insured banks via our partner banks’ sweep networks. The result is your team’s optimal, diversified banking setup — all through a single dashboard.

Learn How Mercury WorksHow we protect your account

Automated fraud monitoring

Our world-class fraud detection and compliance teams work together to build tools and processes that spot unusual activities and stop them in their tracks.

Uncompromising MFA

Proactive protection

Dark web monitoring

Robust ACH authorization

Designate which vendors can initiate ACH debits from your account and receive notifications about any unauthorized payments.

Explore DemoControls that keep you in control

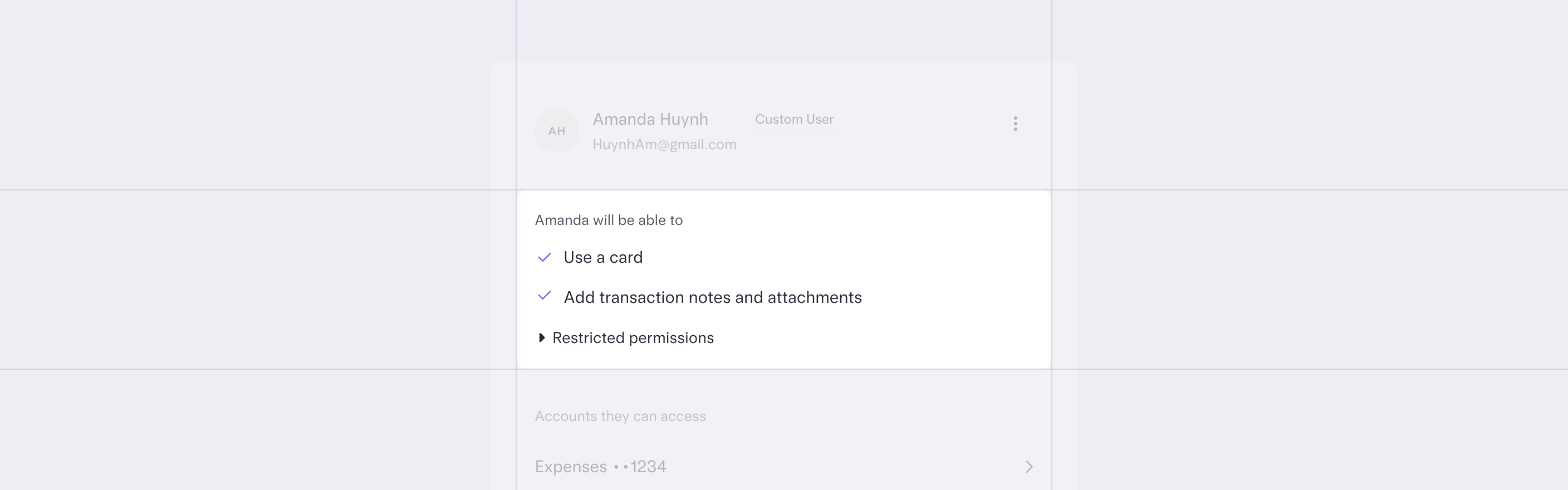

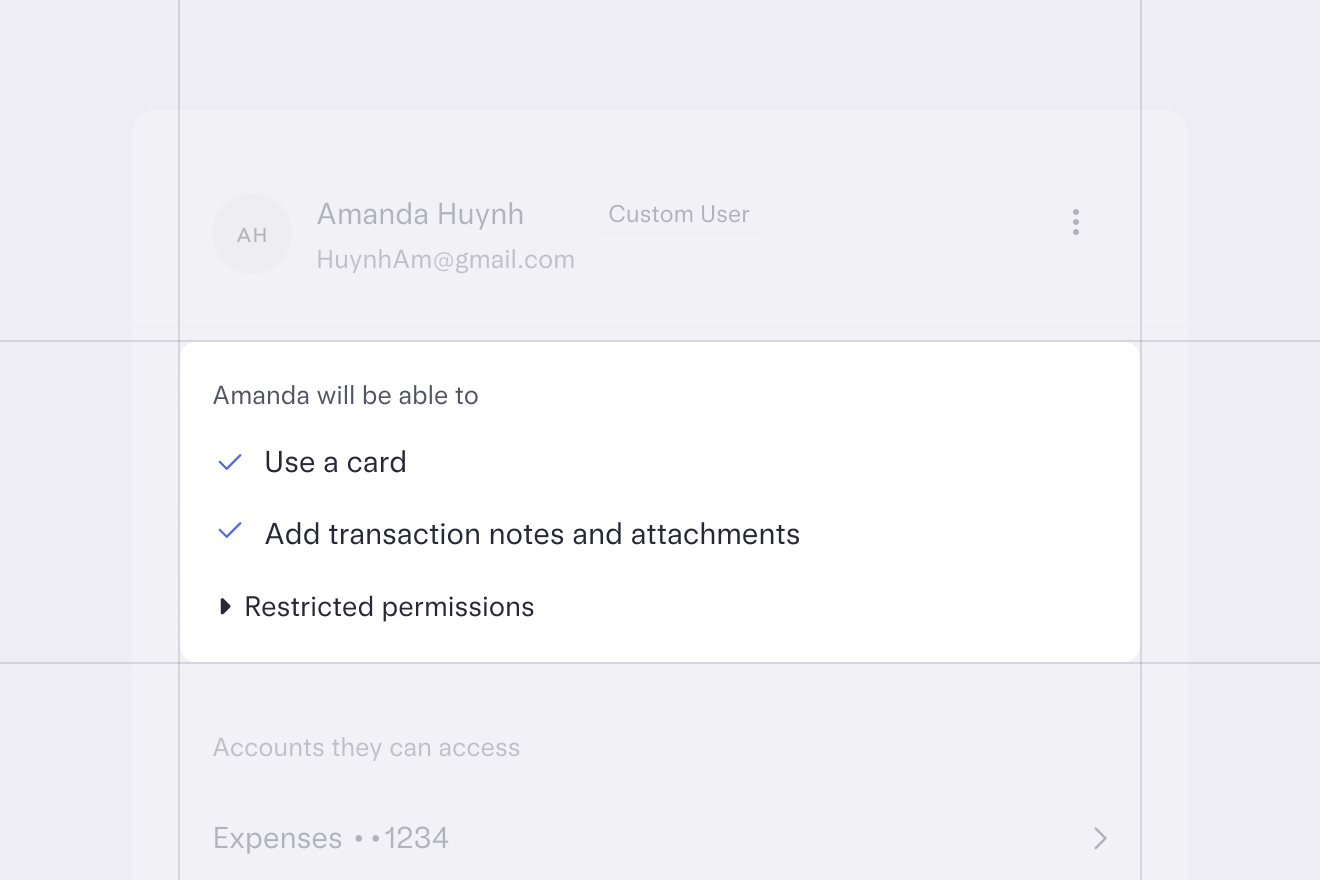

Set user permissions

Give the right level of access to the right people by assigning tiered user permissions to co-founders, accountants, and employees.

Your data. Your eyes only.

Stress-tested by the best

On top of regular internal and external audits, we pressure test our own security system through bug bounty programs and red team assessments. With ongoing employee trainings, we emphasize security as a shared responsibility across the company.

SOC 2 Type II compliance

Robust encryption

PCI standards