Mercury

$0/ Month

Powerful business banking and finance essentials.

Mercury is a financial technology company, not a bank. Banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC.

Let banking power your financial operations

Banking should do more for your business. Now, it can.

Explore DemoComplete any banking task in just a few clicks

An operator’s dream. Mercury combines the speed, simplicity, and smarts that I need to get back to running my business. Search for data or actions, all at your fingertips.

Lindsay Liu

CEO & co-founder, Super

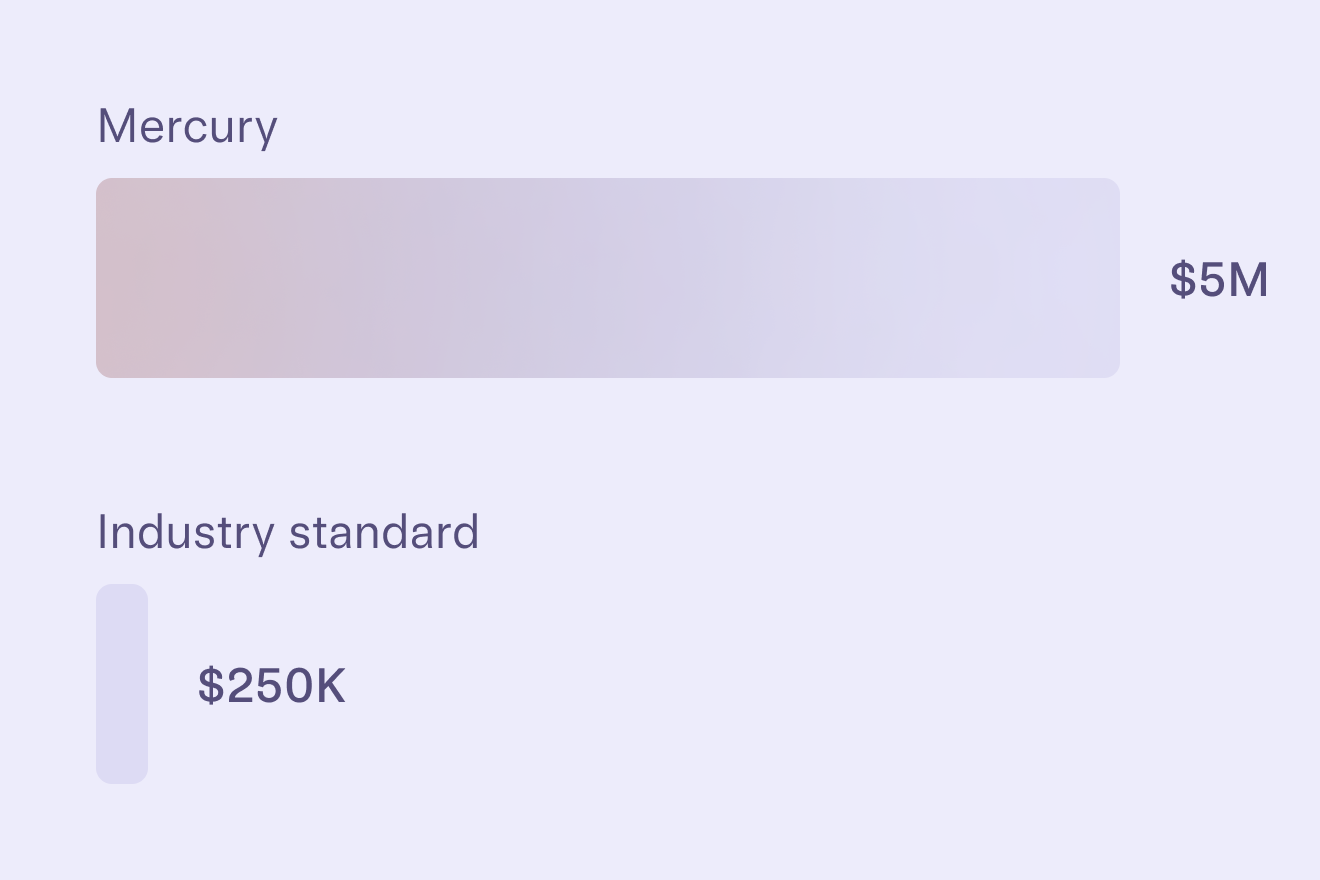

Get up to 20× the industry standard in FDIC insurance through our partner banks and sweep networks.

How Mercury WorksHandle all your bills with precision

Explore Bill PaySeamless invoicing for you and your customers

Explore InvoicingControl spend effortlessly at any size

Manage ExpensesClose the books quickly and accurately

Explore Accounting AutomationsConnect with investors, founders, and experts via our startup success platform

Explore Mercury RaiseI immediately felt welcomed into the founder community. I’ve connected with and exchanged advice with other founders and learned about achieving PMF from AMAs. I highly recommend it.

Charles Meyer

Founder, My Better AI

$0/ Month

Powerful business banking and finance essentials.

$35/ Month

Everything Mercury offers, with more reimbursements and invoicing power.

Unlimited bill payments

Unlimited invoice generation

Recurring invoicing

Branded invoices

ACH debit

+ $1/ACH debit transaction

Reimburse up to 20 users/month

+ $5/additional active user

Xero

QuickBooks

$350/ Month

Everything Mercury Plus offers, with advanced workflows and dedicated support.

Unlimited bill payments

Unlimited invoice generation

Recurring invoicing

Branded invoices

ACH debit

+ $0/ACH debit transaction

Reimburse up to 250 users/month

+ $5/additional active user

Xero

QuickBooks

NetSuite

Relationship manager

Also guaranteed at $10M+ balance

Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust, Members FDIC. Deposit insurance covers the failure of an insured bank.