Mercury Treasury accounts are offered by Mercury Advisory LLC, an SEC-registered investment adviser.

Strategic cash management

made simple

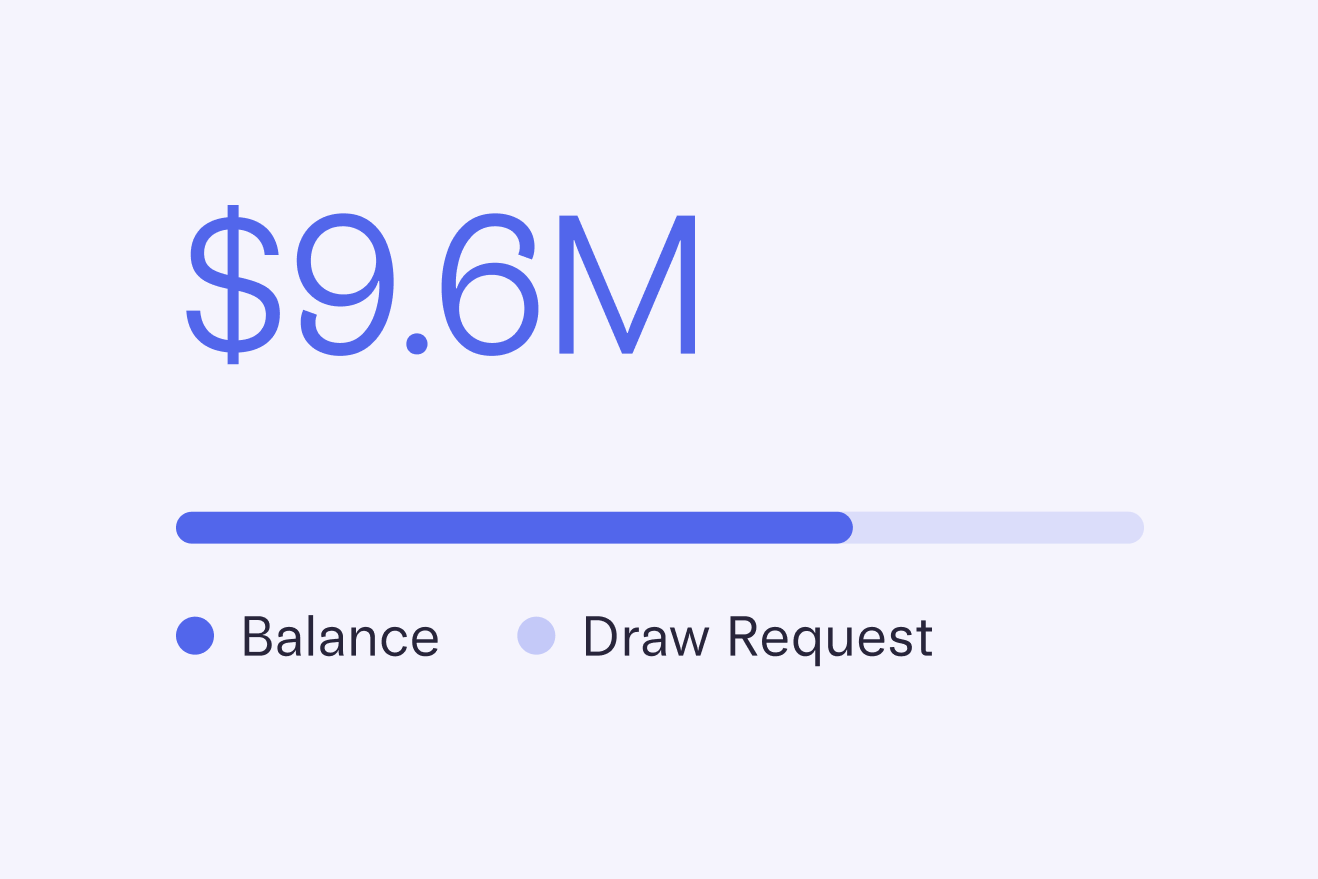

Secure your runway

Your money is invested in lower-risk mutual funds held in your name.

Automate your cash management

Set custom auto-transfers between your operating and investment accounts.

Growth for the long term, flexibility in the short term

Customize your portfolio allocation across top-tier funds

- The J.P. Morgan U.S. Treasury Plus Money Market Fund invests in U.S. Treasury bills, notes, and other obligations issued or guaranteed by the U.S. Treasury

- The Morgan Stanley Ultra-Short Income Portfolio invests in commercial paper and certificates of deposit and carries the highest Fitch rating

- Personalized portfolio management services are available for customers with $25M in Mercury balances

There are no fees to open an account or transact with Mercury Treasury. You’ll be charged a small percentage of your total monthly Mercury Treasury positions at a rate determined by the total deposits held across all your Mercury accounts, ranging from 0.15% to 0.60%. All yield figures are net of fees.

Upgrade to personalized portfolios for a premium experience

Invest on a whole new level with Mercury Treasury Solutions by Morgan Stanley

Contact Us- Qualify with a $25M balance across Mercury accounts

- Maximize yield through a wide range of short-term securities

- Get dedicated, white-glove service from Morgan Stanley’s experienced portfolio management team

Access an entire financial platform powered by your Mercury account

FAQs

Realize your capital’s full potential

Apply online in 10 minutes or less.