One pitch. Plenty of opportunities.

Take the pain out of pitching

Pitching potential investors shouldn’t feel like your full-time job — and with the ability the submit your pitch once in minutes, it no longer does.

Pitch the right people at the right time

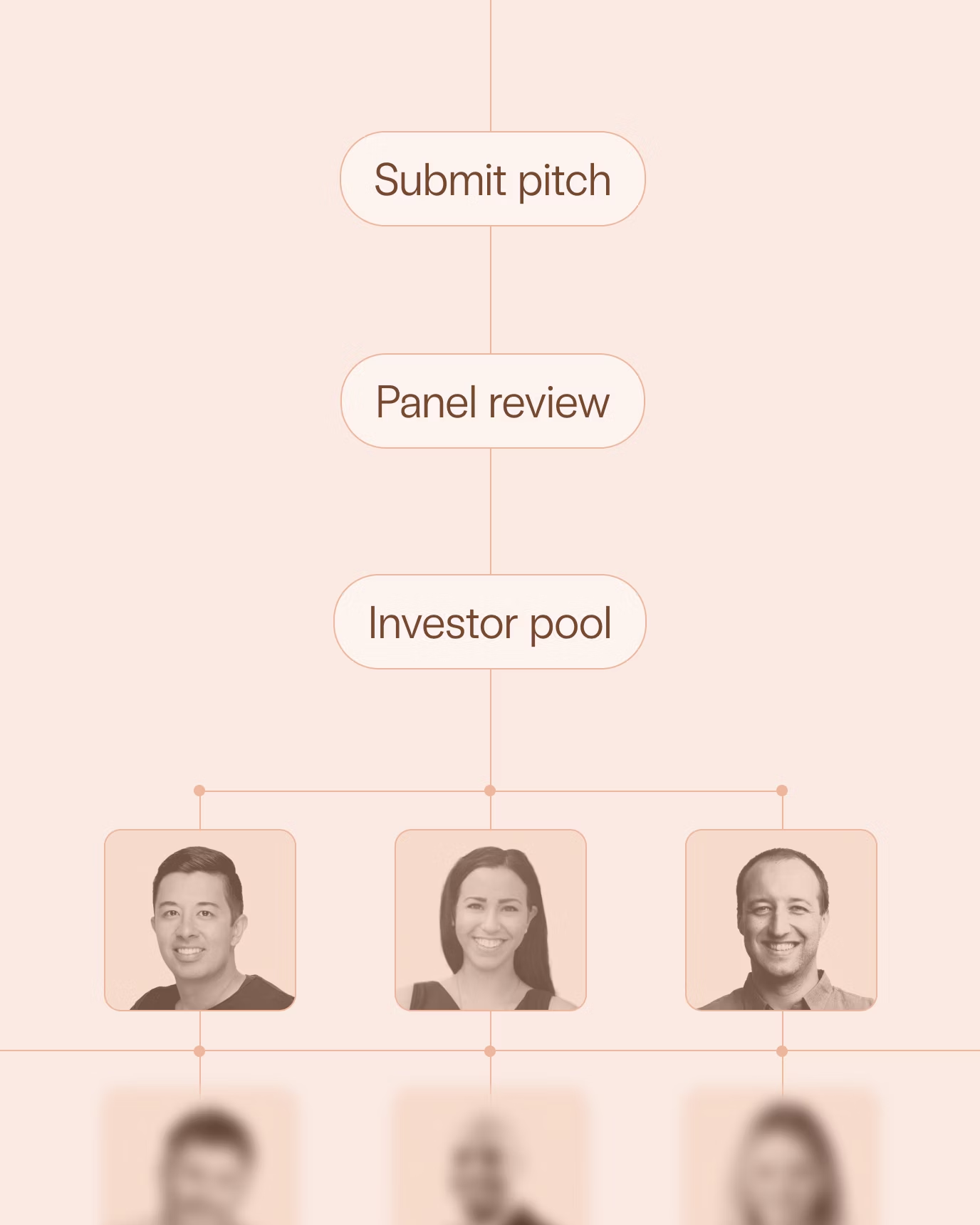

Your pitch will pass through a panel of judges for initial feedback and will potentially be shared as part of our monthly drop to investors looking for companies like yours.

Fly through the pitching process

Submit your pitch in minutes

It takes almost no time at all to make your pitch. Companies of all geographies and industries are welcome.

Become a Raise investor

Join the pool in minutes

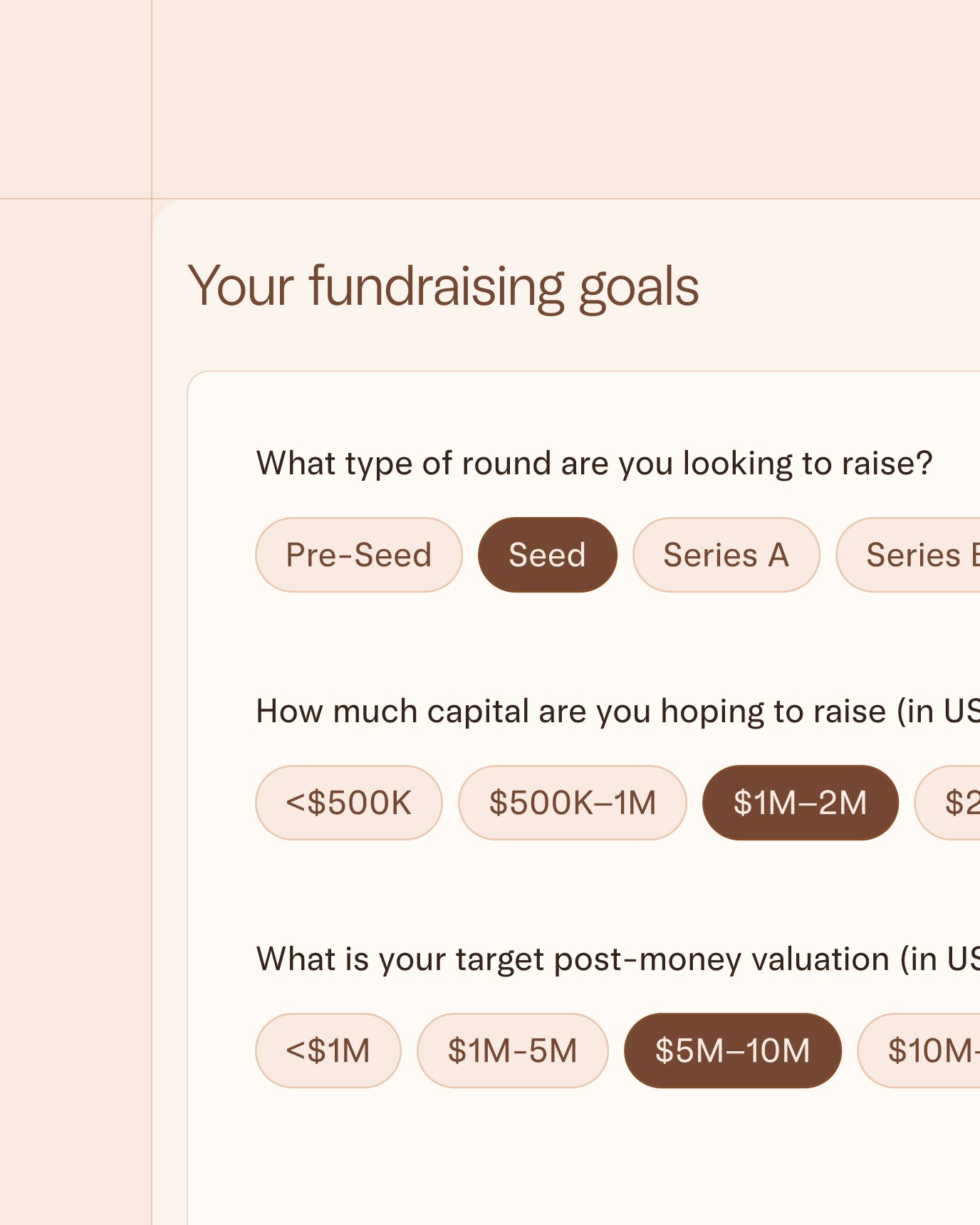

Fill out a short form with your investment criteria so that we can send you the companies you’ve been looking for. You’ll be joining a pool of early-stage funds, solo GPs, angels, and scouts.

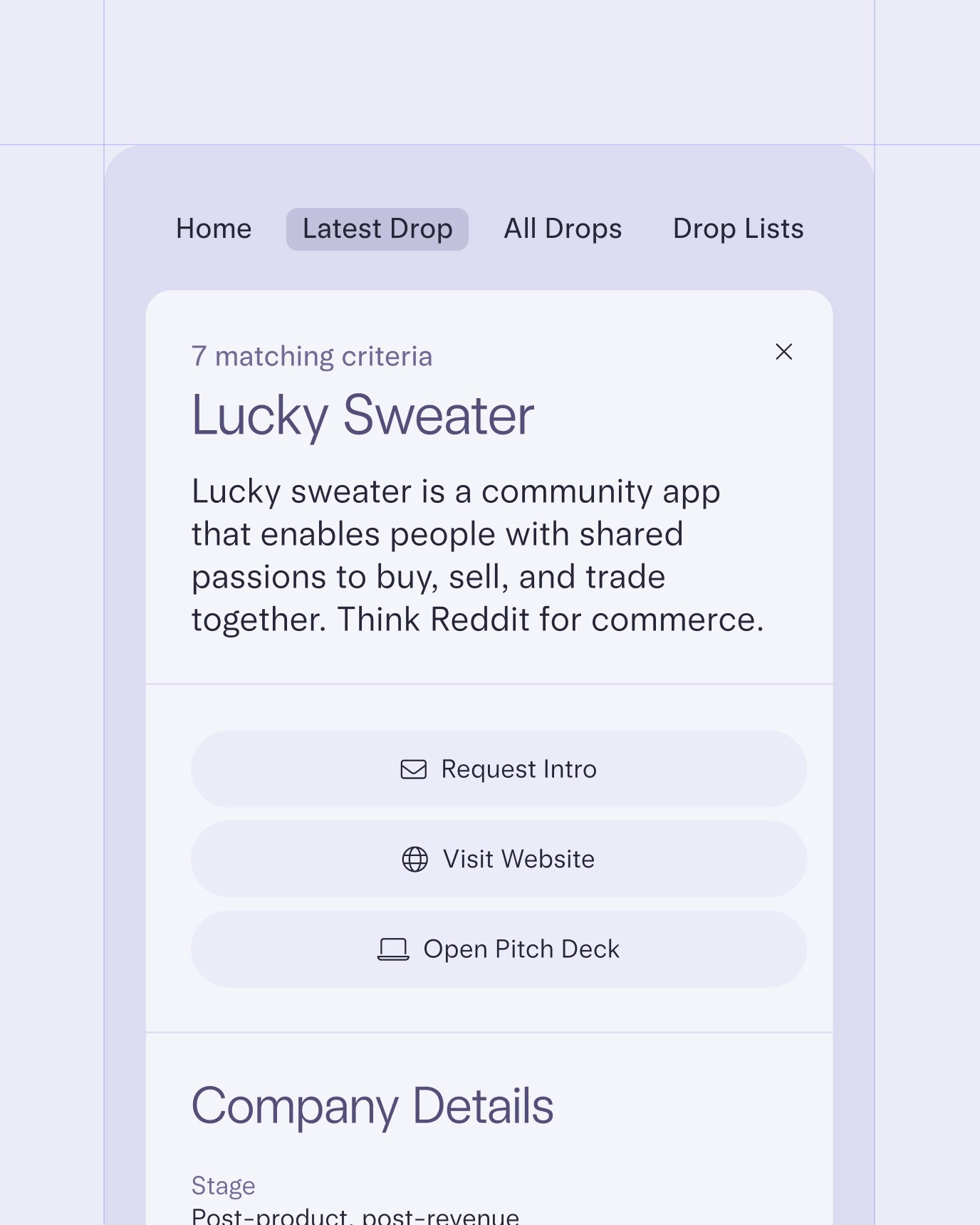

Tap into personalized deal flow

Each month, you’ll receive a fresh, curated “drop” of top startups that fit your investment criteria. With one click, you can request a warm intro and schedule the first check in.

Keep your preferences fresh

To maintain a consistently relevant deal flow, we’ll remind you to keep your info up-to-date in your portal — in case you’re not following that hype cycle after all.

3K+ intros and counting

Raise is a great way to find top-tier startups raising seed rounds.

Allison Barr Allen

Investor

Trail Run Capital

Pre-seed VC firm

We raised $2.5M from firms like Mucker, Pear, and Foundation Capital. Mercury has been crucial to our success & vision.

Justin Clegg

Founder

Allset

Software

Raise has been a great source of new and exciting companies who are actively fundraising.

Josh Kopelman

Investor

First Round Capital

Seed-stage VC firm

After I signed LÜK up for Raise, I received leads from VCs faster than ever. Raise helped us land our lead.

Zach Parker

Founder

LÜK Network

Payroll Software

The companies on Raise are phenomenal. I’ve already committed to investing in one.

Sahil Lavingia

Angel Investor