We’re excited to announce that we’ve completed our community round, via Wefunder. (Check out our website for the most up to date information.)

In late July of 2021, we set aside ~$5M to allow our customers and supporters to join our $120M Series B equity round (led by Coatue). Within 90 minutes of launching our campaign, we had $5M in reservations. In the nine days that our campaign was open, we reached a total of $23M in reservations—a record on Wefunder. Eventually, we had to trim down some investments to comply with the $5M limit set by the government. We closed our community round with ~2,500 new investors on our cap table, 75% of whom are customers.

Our community round was a success and we would love to do it again. We learned a lot from the process, and we hope our learnings can help others who are considering a community round.

Why we chose a community round

For years, customers have asked to invest in us, explaining that they love our product and want to contribute to our long-term success. We’ve always wanted to say yes. As a company, our growth is intricately woven with the growth of our customers. Unfortunately, because of regulations in the U.S. that require investors to be accredited (have a net worth of $1M+), we’ve had to turn these offers down.

So when the SEC updated its equity-crowdfunding regulations (Regulation Crowdfunding or Reg-CF) in March 2021, increasing the amount that private companies could raise in a community round from $1.07M to $5M and allowing investors to be pooled into a special purpose vehicle (SPV), we were excited. The increased maximum made it feasible for us to consider a community round and the work that came with it.

There were many benefits we’d get from having our customers as investors—they would be invested in our success, incentivized to spread the word about us, excited to recommend our product to other founders, provide feedback as we improve, and even become resources for things like hiring. In return, we could improve our product and services, and share any financial upsides with our customers.

The new regulations also coincided with our Series B fundraise and made it easier to run a community round. We were able to use the same subscription agreement for our community round and our other Series B investors. We also used the SPV to group community-round investors on a single line on our cap table. This allowed us to avoid triggering SEC rule Section 12(g), which mandates that companies with 2K+ shareholders, or 500+ unaccredited investors and $25M+ in assets, report as public companies.

The SPV also helped us streamline communications, allowing us to communicate with a single point of contact—the lead investor of our community round, Sahil Lavingia, CEO of ecommerce platform Gumroad. Gumroad was the first company to take advantage of the new crowdfunding rule, raising $5M in March 2021.

Our process and learnings

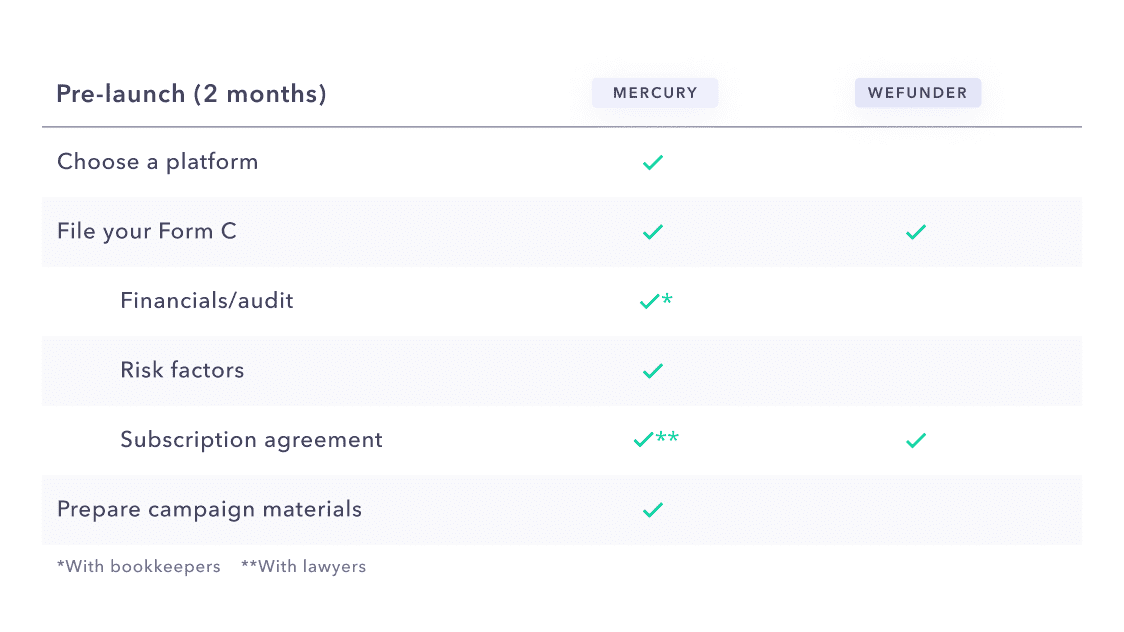

In total, it took about seven months from making the decision to run a community round to closing it.

Pre-launch:

Choose a platform and decide who you’re targeting

It’s important to choose a community round platform that can work with your needs. We chose Wefunder for a few reasons:

- We share similar values, like caring about the success of our customers.

- Wefunder allowed us to take advantage of Reg-CF and use an SPV (not all platforms offer this).

- Wefunder has a straightforward fee structure.

- Wefunder promised—and delivered—excellent customer support.

- Bonus: Our CEO is an investor in Wefunder.

Our priority with raising a community round was to give our customers the opportunity to be investors, so we chose not to be featured on Wefunder’s “Explore” page. However, because we value inclusivity and wanted to expand our brand’s reach, we decided to open the round to those who weren’t customers as well.

Each company will have its own strategy. Other companies may benefit from wide-reaching campaigns that help acquire new customers. In the future, we may consider community rounds that are limited to customers.

File your Form C

Wefunder helped us file our Form C, which is a required document for all businesses that raise capital through Reg-CF crowdfund. These forms are straightforward, except for a few sections that need more effort—financials/audit, risks, and the subscription agreement.

Financials/Audit: Form C requires financials from the past two years. Additionally, an audit is required for community rounds over $1.07M. Audits (especially first-time audits) take a lot of time, money, and internal resources.

- Time: It’s hard to know just how long an audit will take until the process is started. We had a great auditor who ensured the process was smooth. However, because of the complexity of our business, our initial estimate of one month turned into 2.5 months.

- Cost: Audits can be prohibitively expensive for some companies (we were quoted between $30K and $110K for the full audit). It’s helpful to choose an auditor who has experience with the Reg-CF process and understands the difference between material and immaterial requests. The more immaterial requests, the longer the timeline, and the more costly the audit.

- Resources: Because we work with an outsourced bookkeeping firm, we were able to distribute many of our audit requirements. On average, we had one internal jack-of-many-trades spend roughly 10 hrs/week working on the audit, with some help from our bookkeeping firm.

- Record-keeping: Having your records organized is key. Our outsourced bookkeepers were great at maintaining clean financials and keeping detailed notes on financial transactions. Additionally, because we had just completed due diligence for our Series B round, we already had the vast majority of responses to the auditor’s data requests organized.

- Seasonality: If you file your Form C after April 7th, you’ll need to disclose the previous two years of financials. If you file on or before April 7th, the SEC doesn’t expect you to have your financials ready from the past year and will accept financials from the two years preceding it (e.g., 2019 and 2020 financials are accepted if filing between January and April 7th, 2022).

- Age of company + size of round: If you’re a very new company, you’ll have limited operating history, which means you won’t have much to audit. And if you’re raising <$1.07M, you won’t even need an audit. Auditing gets more difficult as your company grows or with bigger rounds.

Risks: We listed the risks that our company faced that potential investors might want to know about, including those that were specific to our industry as well as to the company. This process was relatively simple.

Subscription agreement: Because we wanted our community round investors to have the same terms as other Series B investors, our subscription agreement was straightforward. Our lawyers helped make small revisions to our contract to suit the Reg-CF requirements.

“Testing the waters” (TTW): Once a company files their Form C, they can create a page on a community round platform like Wefunder and solicit investments. However, we knew our audit would take some time, delaying the process of filing our Form C. Because we wanted to announce our community round campaign along with our Series B announcement, we used TTW rules to kick off the campaign. Under TTW rules, we were only allowed to solicit non-binding reservations to investments. Once we filed our Form C, we were able to ask our investors to confirm interest and convert their reservations into investments.

- TTW can be confusing for investors: The additional step after investors filed a reservation with us to confirm their investments led to a few small hiccups and a fair amount of emails to our support team. Ideally, we would have wanted to have our audit and Form C completed before launching the campaign.

Prepare your campaign materials

On Wefunder, you can set up a central page where potential investors can make investments (or if you’re using TTW, make reservations).

- We put together a one-pager and a video to share information about our company (check it out here).

- Wefunder requires that all companies running community rounds hold investor panels. Our investor panel was a recorded Q&A over Zoom, where two seasoned investors asked questions about our business and industry that might be helpful for potential investors.

- We opted to add an FAQ section to our page to reduce potential support and email inquiries.

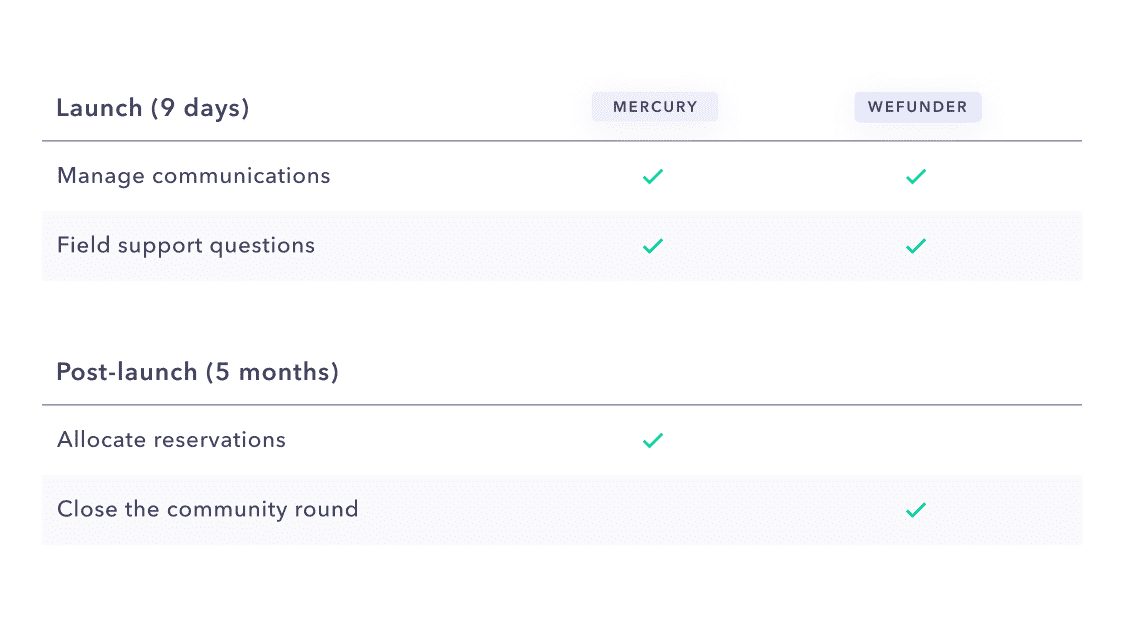

Launch:

Manage communications

We launched our campaign on July 29th in conjunction with our Series B announcement. We sent emails about the campaign to our customers, and shared the campaign on social media and our blog.

We also shared periodic updates with potential investors over email, with details on what to expect and next steps.

Field support questions

Our support team received a fair number of questions during and after the campaign.

- Wefunder has an excellent support team that helps potential investors with their questions. They offered to manage all inquiries that our support team received.

- We tried to field as many of these questions as we could on our own. We armed our support team with a list of FAQs in anticipation of customer emails and updated this list as things evolved.

Post-launch:

Allocate investments

We anticipated oversubscription and wanted to ensure that we prioritized our customers. At the end of our nine-day campaign, we received $23M in investment reservations. To remain under the $5M limit set by the government, we capped allocations based on whether an investor was a customer and how much they held in deposits with us. We also chose to include investors who weren’t customers.

Close the community round

We paused the campaign from accepting new reservations nine days after launch. However, we weren’t able to officially close the round right after—we had to wait until our audit was completed to file our Form C, and had to wait 21 days after filing the Form C before the community round could officially be closed.

- Our audit was completed about a month after we paused our campaign, and we were able to file our Form C shortly thereafter. Once we filed, Wefunder emailed the investors, asked to confirm their reservation amounts, and requested that they send their payments to their platform. Wefunder then aggregated and sent us the funds.

- According to regulations, we had to wait at least 21 days after filing the Form C to formally close the community round and receive the funds from Wefunder. This gave investors sufficient time to confirm that they still wanted to invest (thereby turning their “reservations” into actual investments).

Pros, cons, and why we’re going to do it again

Community rounds can be an excellent way to raise capital, especially for:

- Companies that have a solid community of customers who will support the round, share information, and drive growth

- Companies that struggle with traditional VC fundraising

- Companies that want to create a bigger customer following and more brand awareness

However, community rounds have their challenges.

- You'll need to disclose the last 2 years of financials (for newer companies, you’ll need to disclose your financials since inception).

- You might need to have an audit, which can be time-consuming and expensive.

> For community rounds $1.07m+, you'll need a full audit.

> For community rounds $250k-$1.07m, you'll need a CPA review.

> For community rounds <$250k, you'll need the last 2 years of financials in GAAP format.

- The amount you want to raise may not be worth the time and cost of community-round platform fees, potential audit fees, and legal fees to draft your subscription agreement.

- You have to raise a minimum of $50K in order to receive funds (this is the case on Wefunder; this number varies by platform).

We enjoyed the outcomes of our community round, and would love to do it again (we’re only allowed to do it once a year). We expect the next community round to be easier because we’ll know what to expect—like how much time and money to budget for an audit and to file our Form C ahead of launching our campaign.

We also like doing community rounds in conjunction with traditional VC raises—this ensures that community-round investors are getting the same terms that our VCs are getting, lessens the legal and administrative work involved in drafting subscription agreements (we’d use the same agreement for both), and reduces the time and cost of doing audits (the community round audit is similar to the investor due diligence audit).

Most importantly, we’d like to continue building customer-investor relationships with our customer base, especially with those who didn’t get a chance to join the first time around.

*Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust®; Members FDIC.

Lucia Qian, Head of Business Operations