Everything you need to run your ecommerce finances

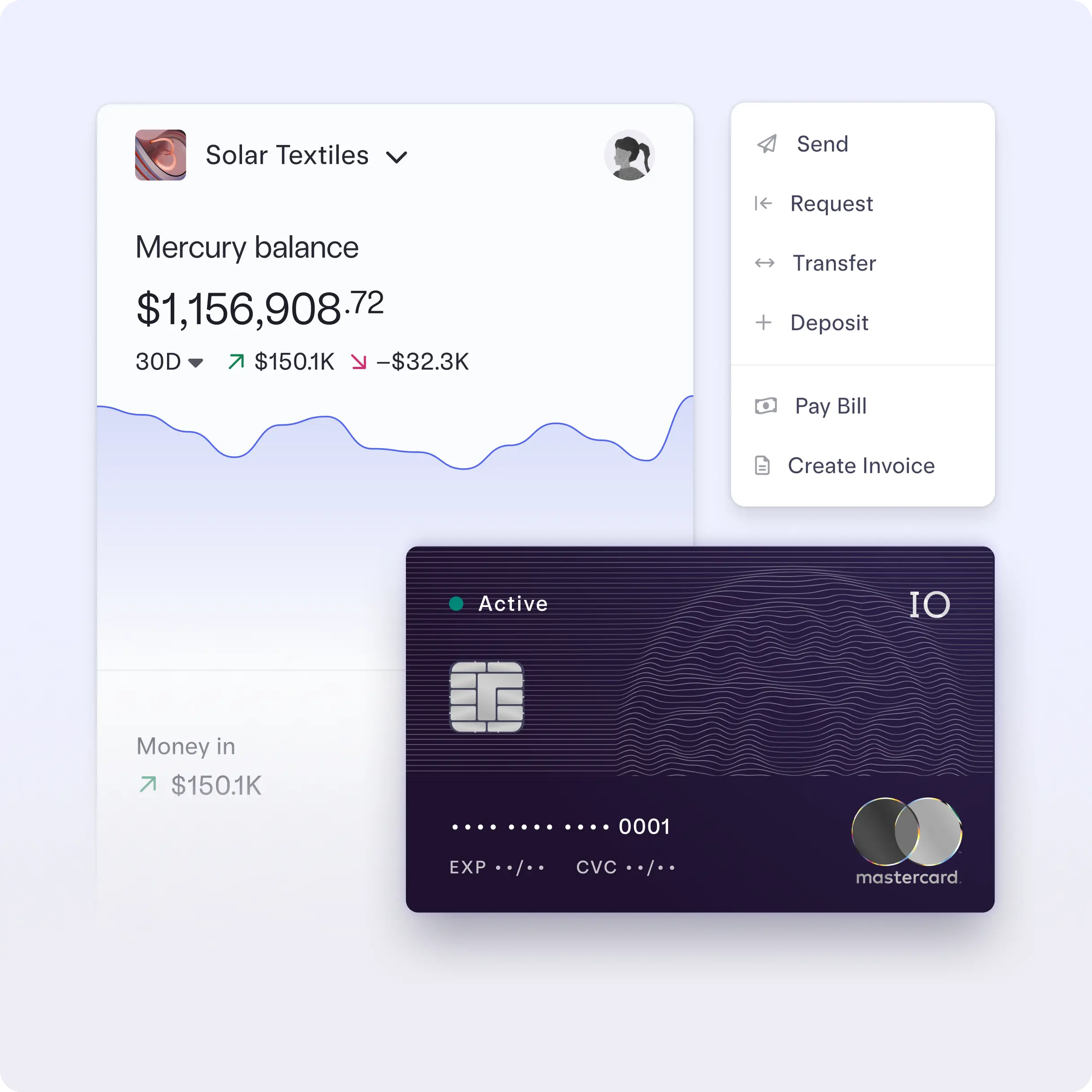

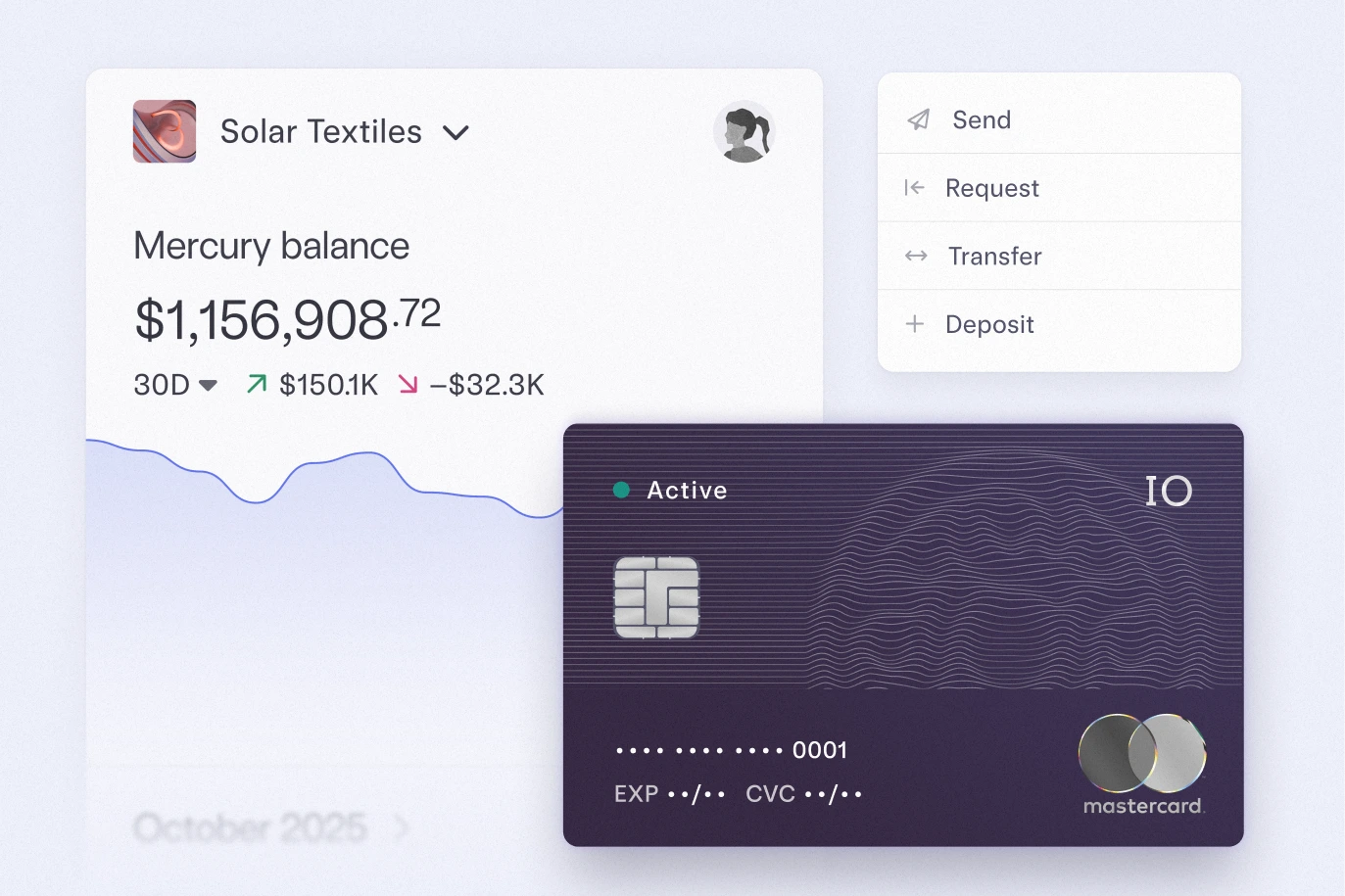

Powerful business banking, without the hidden fees

Open AccountFree ACH and wires in USD, plus payments in 40+ currencies for a 1% fee

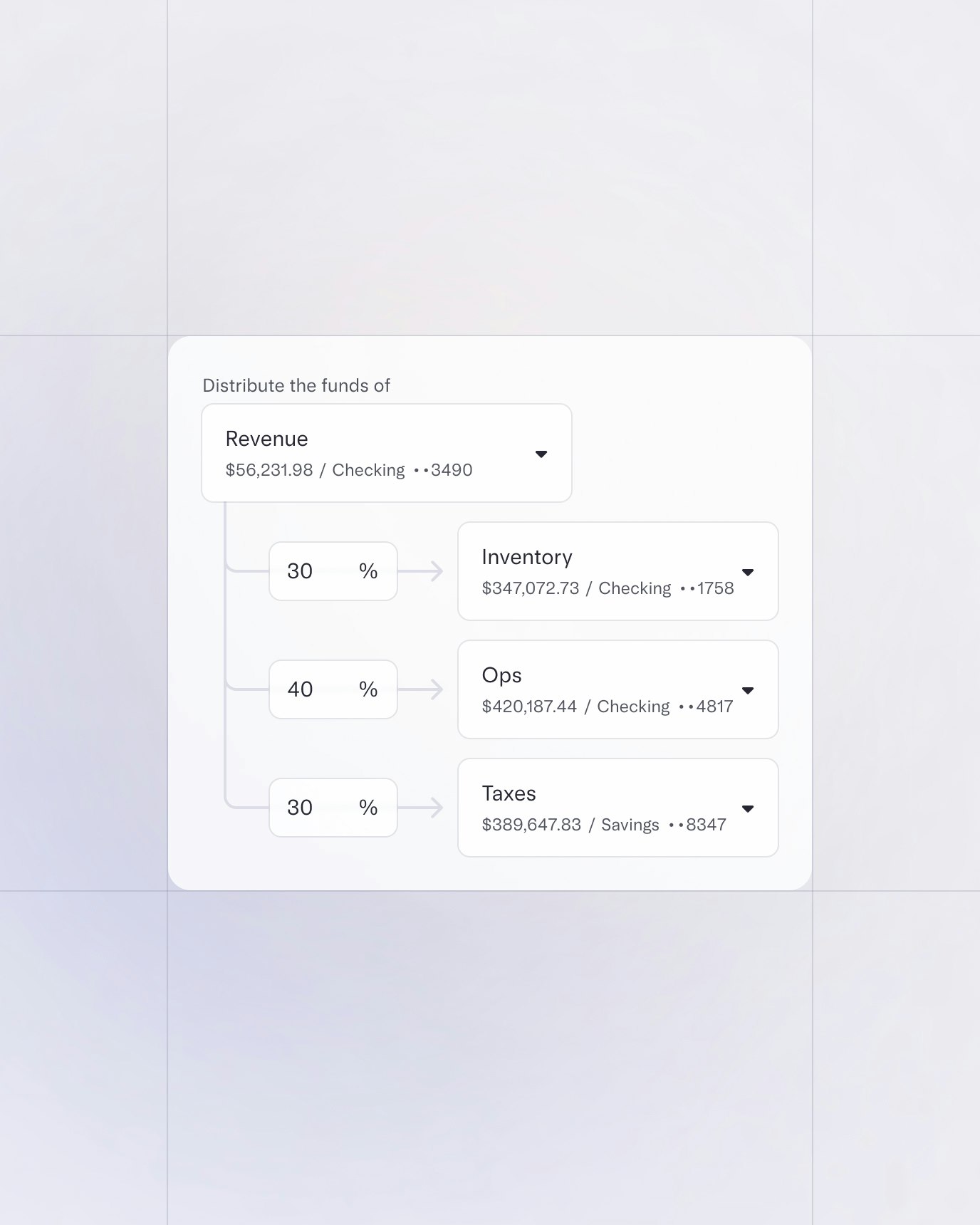

Auto-transfer rules to organize and allocate your revenue

A single place to manage all of your ecommerce finances

Uncapped 1.5% cashback on all credit spend

Explore CardsNo personal guarantee or business credit history required

Easily create physical and virtual cards with precise spend controls

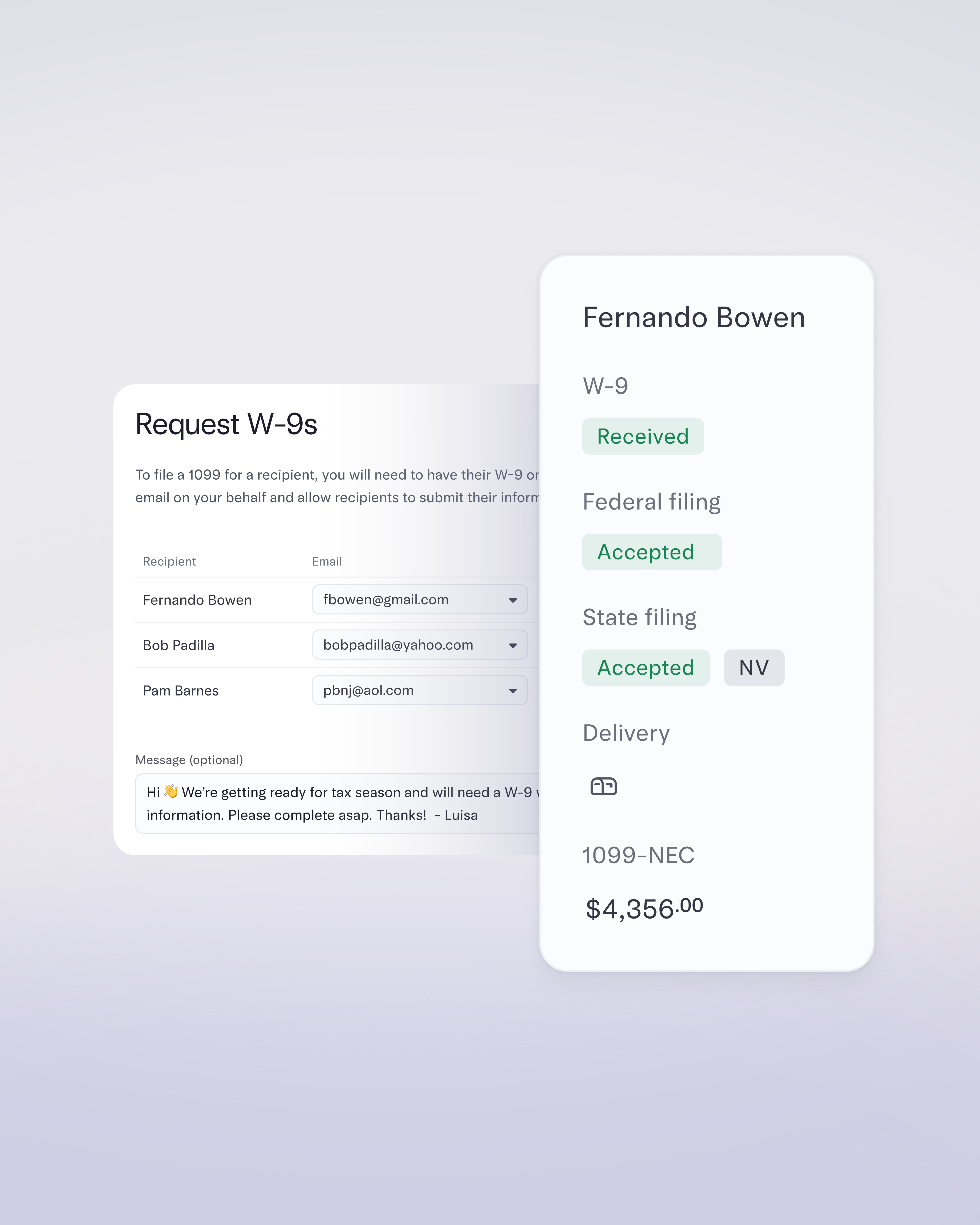

Financial workflows for all the ways your money moves

Explore WorkflowsDrag-and-drop bills to pay your vendors effortlessly

Create professional invoices for your wholesale customers

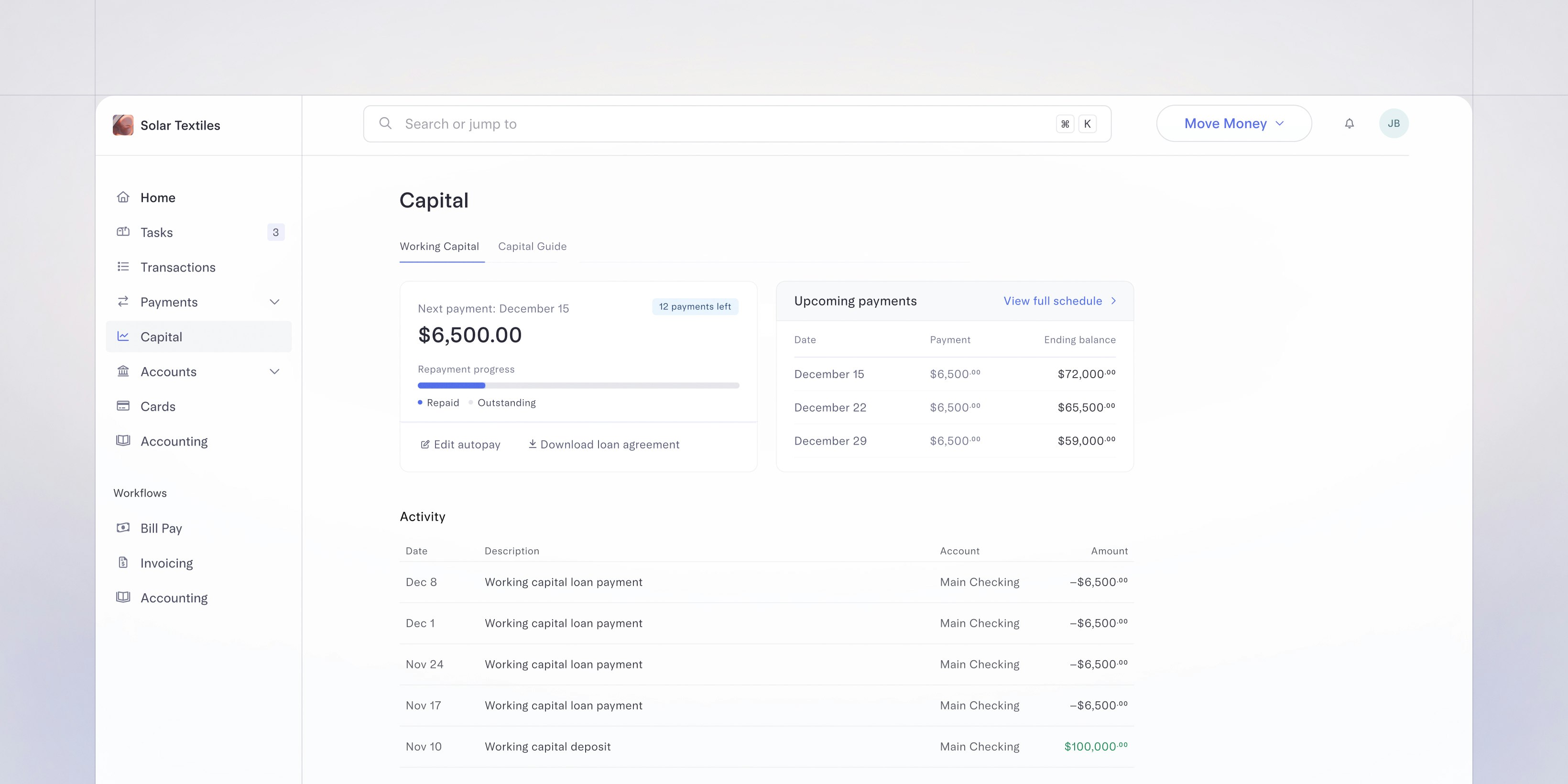

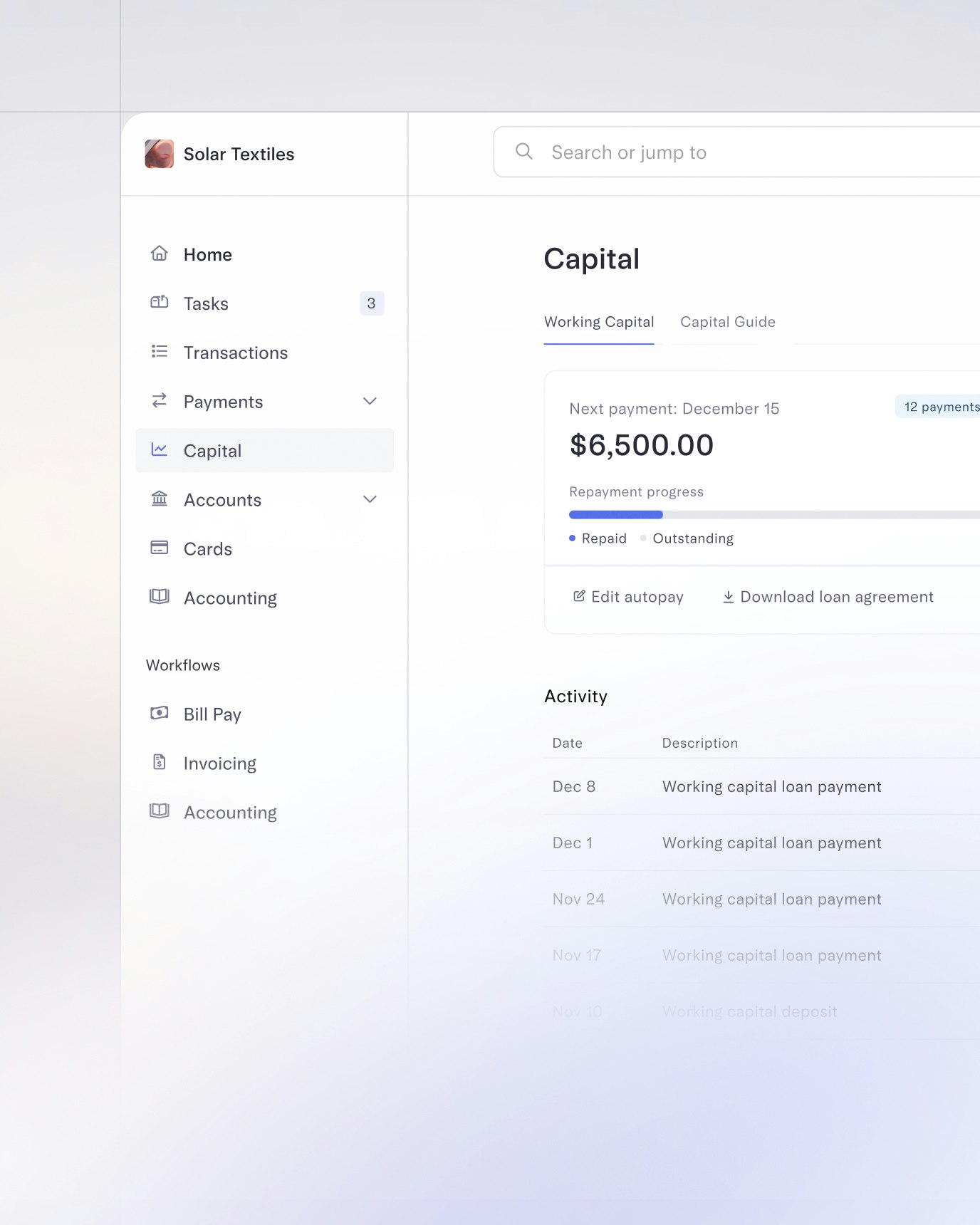

Cash to fund what’s next?

Add to cart.

Flat-fee pricing and competitive rates

Easy-to-understand terms so you know your true cost of capital.

Fixed weekly repayment schedule

Forecast your finances without the unpredictability of revenue-based payback.

Long-term partnership

Get a helpful consultant with ecommerce expertise as you run, grow, and scale.

Mercury is so intuitive and saves us so much time. Plus, free international USD transfers save us a ton of money when we pay our suppliers overseas.

Mark Zhang

CEO, Manta Sleep