Mercury

$0 per month

Powerful banking and finance essentials included with every account.

Let banking power your financial operations

Banking should do more for your business. Now, it can.

Explore DemoComplete any banking task in just a few clicks

An operator’s dream. Mercury combines the speed, simplicity, and smarts that I need to get back to running my business. Search for data or actions, all at your fingertips.

Lindsay Liu

CEO & co-founder, Super

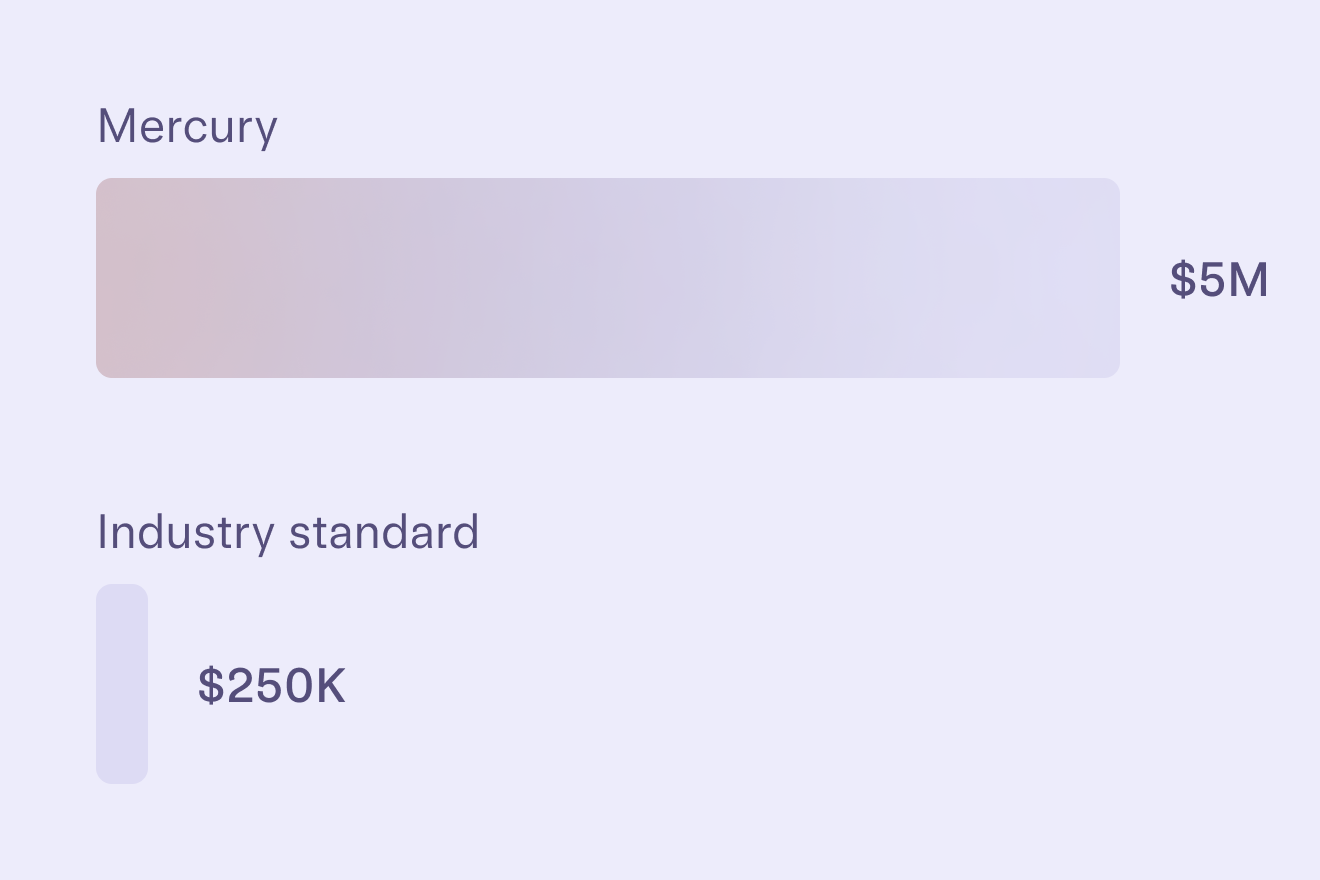

Get up to 20× the industry standard in FDIC insurance through our partner banks and sweep networks.

How Mercury WorksHandle all your bills with precision

Explore Bill PaySeamless invoicing for you and your customers

Explore InvoicingControl spend effortlessly at any size

Manage ExpensesClose the books quickly and accurately

Explore Accounting Automations$0 per month

Powerful banking and finance essentials included with every account.

$29.90 per month

For businesses that need more efficiencies and streamlined invoicing.

Invoice with ACH debit ($1/transaction)

Recurring invoices

Invoicing API (500 invoices created/month)

Multiple GL codes for bill payments

Reimburse up to 20 users/month

+ $5/additional active user

Unlimited 1099 tax filings

$50 off eligible LegalZoom Compliance Plans

$299 per month

For businesses with complex operations that need a relationship manager.

Relationship manager

Invoice with ACH debit ($0/transaction)

Invoicing API (unlimited invoices created/mo)

NetSuite categorizations

Reimburse up to 250 active users

+ $5/additional active user

Unlimited 1099 tax filings

$50 off eligible LegalZoom Compliance Plans